The segment of the flexible workspace in India is currently experiencing a high-profile public market offering with the debut of the initial Public Offering (IPO) of WeWork India Management Ltd. The issue will be subscribed between 3rd and 7th October, with subscription price ranging between 615 and 648 per share. Even though the company is a market leader in the high-end co-working market in India, a conservative investment strategy requires a detailed analysis of the business framework and inherent risks.

Investors must maintain clarity that this is a pure Offer For Sale (OFS), meaning the company itself will not receive any fresh capital from the issue. All proceeds will go to the existing selling shareholders, primarily the promoter, Embassy Buildcon LLP, and WeWork Global’s entity. This structure limits the company’s ability to use the IPO funds for immediate capital expenditure or debt reduction, requiring a focused analysis of its balance sheet strength.

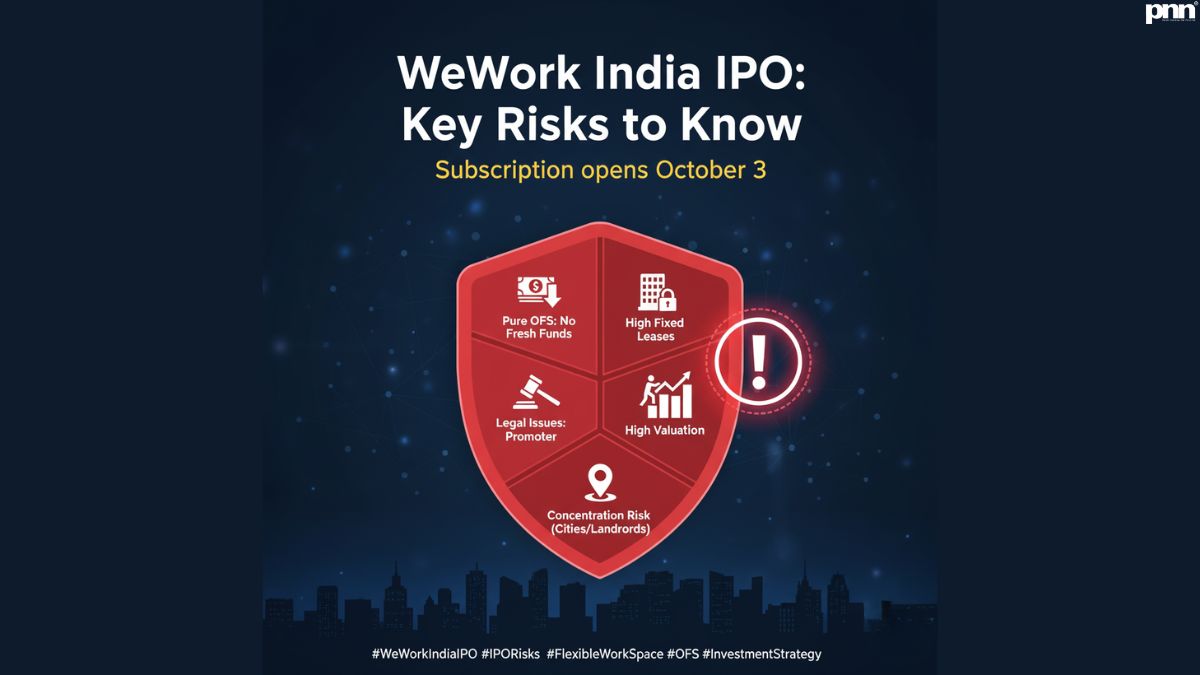

WeWork India IPO Risks and Structural Vulnerabilities

The business model of a flexible workspace operator, heavily reliant on long-term fixed liabilities coupled with short-to-medium-term customer contracts, introduces unique financial vulnerabilities.

1. High Fixed-Cost Lease Commitments

The primary risk stems from the asset-light, yet fixed-cost-heavy, operating model. WeWork India leases large office spaces under long-term fixed-cost lease agreements, typically spanning over years with built-in rent escalations. As of mid-2025, the company has significant long-term commitments across millions of square feet.

This arrangement implies that the company is vulnerable to high fixed costs irrespective of the demand for its desks. When the occupancy rates decrease as a result of the slowing down of economies, alterations in the company’s working policies, or growing competition, the high fixed rent liabilities present a colossal strain on profitability and cash flow. These fixed costs make the whole model dependent on permanence and high occupancy to meet these costs, a factor that is dependent on external commercial real estate cycles.

2. Persistence of Losses and Cash Flow Concerns

Although the company has been characterized by strong increase in revenues, it has been characterized in the past by a track record of net losses, and negative operating, investing and financing activity cash flows over the last several fiscal years. Despite the company reporting a net profit in Fiscal Year 2025, analysts warn that this profitability was heavily fuelled by accounting and tax adjustments, and not a substantial increase in operating profitability measures. The persistence of the negative cash flow should be accompanied by an ongoing review of its capability to cover its working capital needs and debt payment without depending on external funding, which will result in a loss of investor confidence.

3. Legal and Regulatory Proceedings Against Promoter

A critical non-financial risk is the legal and regulatory scrutiny involving promoter entities. The company’s promoter and chairman, Jitendra Mohandas Virwani, has been facing pending proceedings under the Prevention of Money Laundering Act, 2002, since 2014. Furthermore, a group entity has received a show-cause notice from the Securities and Exchange Board of India (SEBI).

Though these actions might not specifically affect the operational assets at WeWork India, any negative outcome would gravely affect the investor mood, corporate image, and open them to closer regulation. Such ambiguity of legal finality introduces a certain element of uncertainty that will inevitably affect the future performance of the stock.

4. High Valuation Compared to Peers

Measurement of valuation, which is one of the aspects of investment discipline, indicates that the IPO is priced aggressively. On the upper end of the band, the stock is priced at about 68 times its Fiscal Year 2025 earnings. This is not favourable to the industry counterparts, which tend to trade at lower multiples. A rich valuation on the day of listing provides virtually no room to make mistakes and very limited opportunity to take advantage of post-listing appreciation of capital, particularly in a market environment in which recent IPO pricing has been inconsistent.

5. Geographic and Landlord Concentration

The geographic concentration is high as the business has a high concentration of revenues and operating capacity within Tier 1 cities, namely Bengaluru and Mumbai. This presents the company with local risks, such as local competition, regulatory changes or disruption unique to these business centers. Moreover, the company has a higher percentage of lease agreements with several main landlords (the top 10 landlords form more than 34% of total area leased). Any conflict, non-renewal or damages of these significant relationships would have a disproportionate impact on the overall operating footprint and financial welfare of the company.

These are structural and financial risks that need to be balanced by investors with the leadership provided by the foundation and the strong brand name of the company in the market before determining the ultimate subscription decision.