Ahmedabad (Gujarat) [India], May 20: Ajooni Biotech Ltd (NSE – AJOONI) – leading and a PURE VEG. animal health care solutions company is schedule to open its Rs 43.81 crore rights issue on May 21, 2024. The funds raised through the issue will be utilised to finance expenditure towards acquisition of Land, site development and civil work, to acquire the plant & machinery; part finance the working capital requirement and corporate purposes. Right issue of the company are offered at a price of Rs. 5 per share – over 20% discount to closing share price of Rs. 6.5 per share on 18 May, 2024. Rights Issue closes on 31st May, 2024. Company promoter group is also participating in the rights issue.

Highlights:

- The company will issue 8.76 crore fully-paid equity shares at an issue price of Rs. 5 per share

- Shares in Rights issue priced at Rs. 5 per share – over 20% discount to closing share price on 18 May 2024; Rights Issue will close on May 31, 2024

- Right Issue funds will be utilised to meet the working capital requirements, fund company’s expansion plans, acquisition of land, acquired plant and machinery and corporate purpose

- The rights entitlement ratio for the proposed rights issue is 1:1, 1 rights equity shares of Rs. 2 each for every 1 equity shares held by the eligible equity shareholders

- CRISIL Limited has raised company’s long-term credit facilities ratings to “CRISIL BB+/ Stable”

Ajooni Biotech Ltd

(A Pure Veg Animal Healthcare Company)

The Company will issue 8,76,13,721 fully paid-up Equity Shares of the face value of Rs. 2 each for cash at a price of Rs. 5 per Equity Share aggregating to Rs. 43.81 crore. The Rights entitlement ratio for the proposed issue is fixed at 1:1 (1 equity shares of face value of Rs. 2 each for every 1 equity share held by the equity shareholders on the record date – May 7, 2024). The last date for On-market Renunciation of Rights Entitlements is 27 May, 2024.

Company is planning to establish a new plant with an investment of Rs. 16.50 crore at G.T. Road in Khanna, Punjab (adjacent to their existing plant) spanning 87,000 sq ft. The new unit will be entitled for incentives including 3% interest Subvention, Capital subsidy of Rs. 50 lakhs offered by Government of India, 100% GST and 100% stamp duty reimbursement among many others.

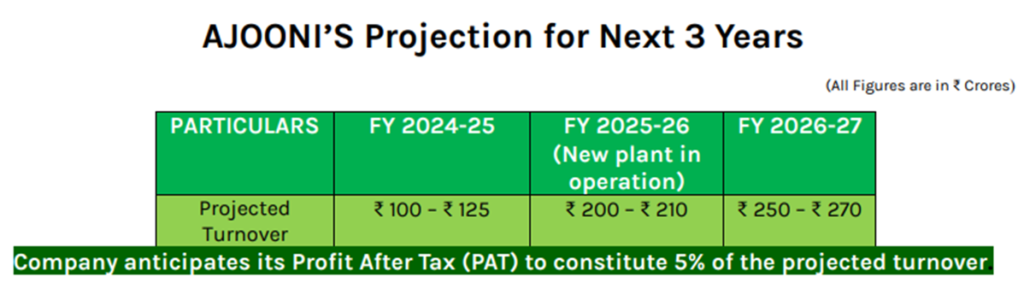

In the next 2-3 years company projects its turnover to reach in the range of Rs. 250-270 crore in FY 2026-27 and anticipates PAT margin of 5% of the turnover.

(Source: NSE)

Mr. Jasjot Singh, Managing Director, Ajooni Biotech Ltd said, “We specialize in offering high-quality, pure veg cattle feed & pure veg supplements that cater to the dietary needs of cattle. Our products are designed to promote healthy growth, improve fertility, and enhance overall well-being in cattle. With our focus on animal health and welfare, we’re committed to providing farmers with the best possible solutions for their cattle. We’re now entering the B2C market, marking a significant expansion of our business scope. This new initiative will allow us to reach individual consumers directly, offering them a wider range of products and services. It will also improve the top line and bottom line of the Company. We’re in the process of appointing new dealers and in the first month more than 100 dealers itself have already been appointed on PAN India basis by the company. Proceeds of the issue will further strengthen company’s balance sheet and help fund its expansion plans and strategic growth initiatives.”

CRISIL Limited has raised company’s long-term credit facilities ratings to “CRISIL BB+/ Stable”. This upgrade underscores company’s ongoing efforts to improve risk profile, revenue streams, and operational profitability. It highlights the significant expertise of company’s promoters, strong customer partnerships, and favourable financial risk position. Although company recognize the potential impact of fluctuating raw material prices, they are fully committed to managing and minimizing such risks.

On 17 May 2024, company has signed an MOU with Unati Agri Allied & Marketing Multi state Cooperative Society Limited (UAMMCL). This partnership aims to enhance PURE VEG. Cattle feed business through forward and backward integration, encompassing Raw Material Supply, Warehousing, Storage, Consumer Connectivity & Research and Development within the operational area.

As part of its strategic growth plan, Ajooni will adopt modern irrigation techniques for cultivating Moringa plants. In collaboration with UAMMCL, the company will initiate the Moringa plantation process from the ground up, progressing to the processing of Moringa leaves and seeds to manufacture final products, focusing on both PURE VEG. animal and human nutrition as well as renewable energy solutions. UAMMCL is supported by Department of Biotechnology (Government of India) & Punjab State Council for Science & Technology.

Established in the year 2010, Ajooni Biotech Ltd is India’s first pure veg cattle food company to have ZED Gold process under MSME – Make In India initiative dedicated to improving the productivity of Dairy farmers and sustainably increase livestock yields. Company has two state-of-the-art manufacturing facilities with a cumulative Animal feed production capacity of 1,60,000 MTPA and liquid supplements capacity of 30 lakh Litres per annum. Company is currently working with more than 10,000 farmer families in seven states of Northern India and plans to grow nationally. I

For FY 23, Company reported sales of Rs. 74.5 crore and Net profit of Rs. 1.12 crore. Company has achieved strong CAGR of 23% in Sales and 45% in Net Profit during the last 3. Company came up with it’s IPO on NSE Emerge platform in December 2017 & migrated to the main board of NSE in May 2022.

About Ajooni Biotech Limited

Ajooni Biotech Limited is a PURE VEG. animal health care solutions company. It stands as a trailblazer, innovator, and frontrunner in the realm of animal feed production, prioritizing excellence in quality, safety, and production innovation, along with a commitment to delivering exceptional customer service.

With a comprehensive feed range, AJOONI has emerged as a significant player in the animal pure veg. feed and pure veg. feed supplement. Opting for AJOONI signifies partnering with a responsive, attentive ally boasting extensive experience and a nuanced understanding of the intricate dynamics within the livestock market.

AJOONI’s primary objective revolves around optimizing productivity, meeting animals’ Pure Veg. nutritional and feed requirements comprehensively, and attaining an optimal dietary balance.

Company aims to be a steadfast ally to farmers, with our team of experts offering their wealth of knowledge and years of experience to devise tailored diet programs and provide optimal recommendations for the sustained growth and advancement of livestock. Other than Ajooni there are very few companies in the organized listed space which is into Pure Veg. cattle feed & supplement feed in India.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.