New Delhi [India], October 6: For years, Indian crypto users have faced the same dilemma: you can invest in Bitcoin, Ethereum, or stable coins — but good luck trying to spend them on groceries, ad campaigns, or flight tickets. Despite India having one of the largest crypto user bases in the world, everyday usage of digital assets has remained a puzzle.

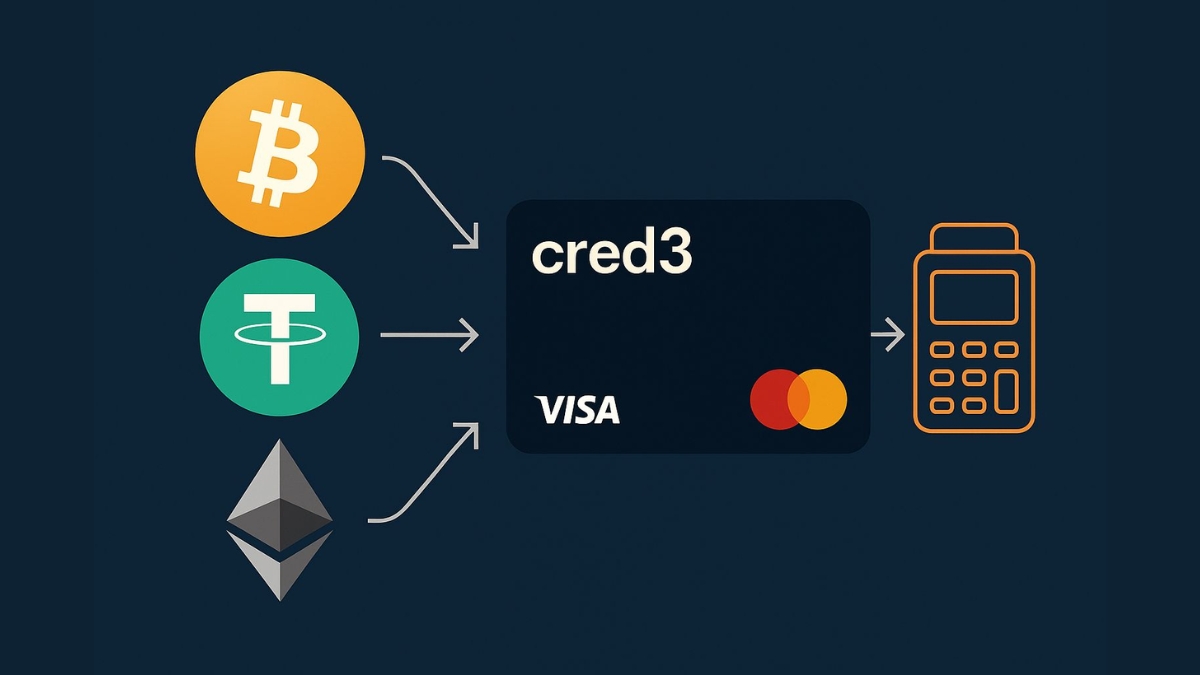

Enter Cred3.Cards, a reloadable crypto-to-fiat card that works just like any other Visa or Mastercard. Built by DiQiquartz UAB, a licensed financial company based in Lithuania, Cred3 is aiming to close one of the biggest gaps in the crypto world: real-world usability.

How It Works

The idea is refreshingly simple.

- Load the card with crypto (BTC, ETH, USDC, and more).

- Swipe or tap anywhere Visa/Mastercard is accepted.

- Your crypto gets instantly converted into fiat at checkout.

No waiting on exchanges, no manual conversions, no messy withdrawals. Just swipe your card and go.

Why This Matters in India

Indian users have been early adopters of crypto, but regulations and payment roadblocks often leave them stuck when trying to use those assets in daily life. That’s why Cred3 is quickly finding fans here.

- Ads Payments Made Easy: Many start-ups in India struggle when INR-based cards fail on Google Ads or Meta Ads. Cred3’s globally recognized card solves this instantly.

- Travel Without Forex Hassles: Whether booking hotels in Europe or withdrawing cash in Dubai, Cred3 works like a regular international card.

- Universal Acceptance: Any merchant that accepts Visa or Mastercard — and that’s more than 100 million globally — accepts Cred3.

- Instant Reloads: Top-up in minutes directly from your crypto wallet.

For users, it feels less like a “crypto workaround” and more like a natural extension of everyday banking.

A Look at the Features

- Reloadable with major cryptocurrencies.

- Backed by both Visa and Mastercard — rare for crypto cards.

- Supported by established global banks for smooth settlement.

- Real-time dashboard to track spending and reloads.

- Licensed under EU regulations with full KYC and AML compliance.

Real-World Scenarios

- The Start-up Founder: Finally able to run international ad campaigns without payment blocks.

- The Digital Nomad: Travels across Europe and pays with crypto as easily as locals use their debit cards.

- The Everyday User: Orders food online, pays subscriptions, or shops for essentials with crypto.

Standing Out in a Crowded Market

Crypto-linked cards are not new — but most competitors come with limitations: restricted regions, reliance on a single payment network, or weak banking partnerships.

Cred3 avoids these pitfalls by combining Visa + Mastercard coverage, solid European licensing, and a focus on Indian users who want practicality, not hype.

Security First

Every cardholder goes through proper verification, and transactions are protected with bank-grade fraud prevention. Funds are managed within a secure, compliant framework, giving users the reassurance that this isn’t just another short-lived crypto experiment.

The Bottom Line

India has millions of crypto users but until now, they’ve had very few ways to use their holdings in everyday life. Cred3.Cards may finally be the bridge between crypto wallets and the real economy — letting users spend their Bitcoin or USDC as effortlessly as rupees.

Whether you’re a founder frustrated with ad payments, a traveler tired of forex hassles, or someone who simply wants to swipe crypto like cash, Cred3 makes it possible.

Crypto in. Fiat out. Swipe anywhere. That’s the future Cred3 is building.

Disclaimer: Cred3 operates in full alignment with international financial standards and encourages users to remain aware of and comply with all local crypto-related laws, tax obligations, and regulatory guidelines applicable in their country of residence. As with all crypto transactions, users should exercise discretion and understand the inherent risks involved.

Disclaimer: This content is for informational purposes only and does not constitute financial, legal, or investment advice. Readers should verify information independently or consult a qualified professional. The publisher is not liable for any actions taken based on this content.